How concrete and abstract marketing can affect home-buyers' mortgage decisions

- Global and Strategic Marketing Research Centre

Getting a mortgage is perhaps one of the most significant long-term commitments that consumers in developed countries make. It’s the quintessential American Dream – owning a first home or upgrading to a larger house.

Unlike the UK, the US housing market tends to offer fixed-rate mortgages over a much longer period – 20-30 years as opposed to the UK’s 2–5-year rates. The cost of mortgage borrowing and payments on outstanding household debt can have a huge impact on the rate of growth of a country’s economy, as seen after the 2008 subprime mortgage crisis in America. (Subprime mortgages are offered to those generally with low credit scores and problems with debt. The monthly payments have much higher interest rates than those with “prime” mortgages as the subprime mortgage holder is viewed as riskier.)

My research focuses on American consumers’ mindsets about whether they perceive their finances to be scarce or abundant (i.e. whether they regard themselves as having limited funds or large amounts of money available) and how this affects how they respond to different types of message framing (what is said and how it is said) in housing adverts.

Fantasy versus reality

When consumers consider buying their potential new house, they actively look and compare the reality of this decision (such as house prices, mortgage rates, risks and their income) to a fantasy (cornflower blue walls, an extra bedroom for the kids’ nursery, or a terraced balcony).

Within recent years the real-estate market is exaggerated, and feeds into an average American millennial consumer’s fantasy. This online fantasizing can be seen with a rise in a number of real-estate dedicated websites like Zillow, StreetEasy, Realtor.com, and Instagram and Pinterest accounts such as @circahouses, @cheapoldhouses or @sf_daily_photo. Also known as #RealEstatePorn, these websites and social media accounts allow consumers and real-estate enthusiasts to indulge in their daydreams.

Fantasy house-shopping became a popular past-time of consumers during the coronavirus lockdown of 2020, with people spending more time in their own homes, dreaming of where else they could be living.

Consumers tend to contrast this fantasy with their reality – the state of their finances. Decision making is dependent on their perception of their financial resources being scarce or abundant.

About this research

Consumer research has shown that scarcity is embedded in the individual’s subconscious mind. Instead of just being related to the quantity of an object (such as money or product), contextual as well as situational cues can trigger a scarce or abundant mindset. Consumers are often exposed to contextual and situational cues regarding financial resource scarcity within their environment, especially since the 2008 subprime mortgage crisis.

More recently, the trigger of financial resource scarcity has been heightened during the COVID-19 pandemic. Cues such as news articles, promotions and advertisements feature headlines such as “The economy won’t snap back after Covid-19” or “Coronavirus economic tracker: latest global fallout” in the Financial Times in June 2020. These are similar to 2008/2009 financial headlines such as “The recession tracks the Great Depression” or “How the financial crash made our cities unaffordable”.

In collaboration with Professor J. Josko Brakus and Dr Alessandro Biraglia, I am studying how scarcity/abundance mindsets interact with abstract/concrete mortgage advertising. Abstract advertisements are less specific, less detailed, and open up possibilities for imagination, whereas concrete adverts are closer to reality, specific and detailed, and leave less for the imagination.

We also explore the notion that an abundant mindset, as opposed to a scarce mindset, makes consumers more curious and have a concrete idea of purchasing a mortgage, making them more likely to look at houses in a detailed manner. Curiosity is triggered by people wanting to fill in knowledge gaps. When consumers are presented with abstract mortgage advertisements - those that are less detailed and specific - they want to find out more and resolve these knowledge gaps because of their state of curiosity. Thus, abstract images can increase consumers’ curiosity. Although, depending on their financial situation, consumers may be more curious about certain concrete advertisements to make mortgage purchase decisions.

To date, there has been little research into reality versus fantasy mindsets. It is necessary to understand this mix to avoid housing bubbles such as the 2008 subprime mortgage crisis. The crisis occurred due to poor regulation of the banking sector and their excessive risk-taking while targeting consumers within low-income brackets and less security. Banks and financial institutions were not reining in customers’ fantasies with what they could actually afford, as ineffective messages were being communicated to consumers within low-income brackets.

Results

We conducted a field study through the Google Ads platform, involving 7,472 American consumers in high and low-income neighbourhoods (representing the abundant versus scarce mindsets respectively). The study was circulated amongst 556,304 consumers.

We created and circulated two versions of a fictitious mortgage advertisement: a more “abstract” version (showing an empty plot of land where a house could be built) and a more “concrete” version (with a house already built). These advertisements were circulated after a successful manipulation check conducted online on 400 American consumers data-set.

Abstract advertisement (left) and concrete advertisement (right)

The results of the study showed that:

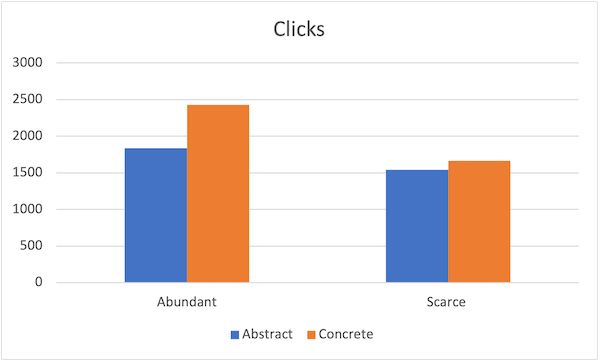

- Those with abundant mindsets tended to be more curious and had higher purchase intentions as they clicked on the advertisements more than those with scarce mindsets. They also had a preference for the concrete advert.

- Those with scarce mindsets clicked on the Google Ads fewer times. They had also had a marginally higher preference for the concrete advert.

Figure: Purchase Intentions of Scarce (Deprived) and Abundant (Abstract) Mindsets

We also conducted two lab experiments (online survey design) to investigate the interaction of abstract/concrete messaging with scarce/abundant mindsets, studying approximately 500 consumers. The first lab experiment showed that abstract advertisements increase consumers’ curiosity and therefore purchase intentions. The second lab experiment, where scarce/abundant mindsets were primed, confirmed the results of the Google Ads study - that financial resource mindset intensifies consumers’ curiosity and purchase intentions when exposed to concrete advertisements.

Implications for financial services and the housing market

Financial institutions and the banking industry have been changing their advertising practices to increase consumer confidence since the 2008 recession. However, no advertising standardisation has been conclusively established by the financial industry through research.

Our findings could help financial services decide on effective messaging (concrete) for diverse income segments (high or low). Effective advertising would help nudge consumers to make responsible, financial decisions - encouraging a better borrowing decision, particularly impacting those consumers at the greatest financial risk.

The American government has increased the country’s spending to avoid another housing bubble and crisis in 2020. It is our recommendation to frame the policy to encourage responsible spending within a scarcity triggered environment (e.g. times of recession) using effective message framing for particular income segments. This could help avoid future housing bubbles, such as the one that occurred during the 2008 subprime mortgage crisis.

Contact us

If you would like to get in touch regarding any of these blog entries, or are interested in contributing to the blog, please contact:

Email: research.lubs@leeds.ac.ukPhone: +44 (0)113 343 8754

Click here to view our privacy statement. You can repost this blog article, following the terms listed under the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International licence.

The views expressed in this article are those of the author and may not reflect the views of Leeds University Business School or the University of Leeds.