Economic Seminar Series - The Role of Macroprudential Policy in Times of Trouble

- Date: Wednesday 9 March 2022, 15:30 – 17:00

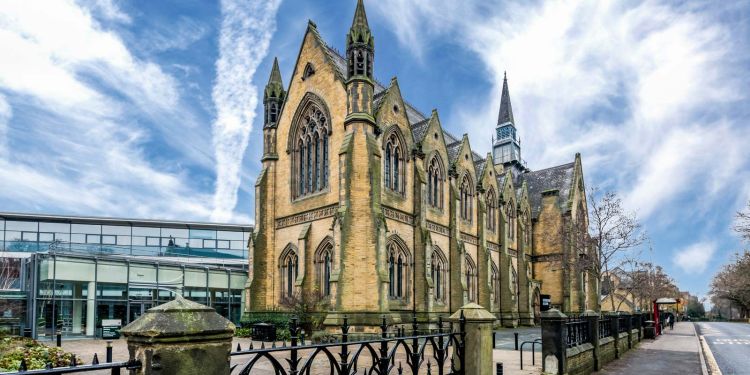

- Location: Business School Maurice Keyworth LT (G.02)

- Type: Alumni, Seminars and lectures, Online

- Cost: Free

You are invited to a seminar by Jagjit S Chadhu from the NIESR and the University of Cambridge on 'The Role of Macroprudential Policy in Times of Trouble'.

Please click here for on campus registration or here to register via Zoom.

Abstract:

We develop a DSGE model with heterogeneous agents, where savers own firms and risk pricing banks while borrowers require loans to establish their consumption plans. The bank lends at an external finance premium (EFP) over the policy rate as a function of the asset price, housing collateral, the demand for loans and their perceived riskiness. We suggest that the close relationship between aggregate consumption and house prices is related to collateral effects. We also outline the role of the EFP in determining consumption spillovers between borrowers and lenders. We solve the model with occasionally-binding constraints to examine the redistributive role of macro-prudential policies in terms of welfare. Countercyclical deployment of the loan-to-value constraint placed on borrowers can limit the scale of the downturn from a negative house price shock. Furthermore, when the zero lower bound acts to constrain monetary policy, looser macroprudential policies can act as an effective substitute for lower policy rates. Finally, we show that co-ordinated macroprudential and fiscal policies can also attenuate the welfare losses that arise from uncertainty banks may face about default probabilities.

All are welcome to attend. Light refreshments will be provided.