About us

Come to Leeds and change the world for the better

In a world of complexity and constant change, we recognise the opportunities to make a positive difference.

For people. For business. For society

More on For people. For business. For society

Research Excellence Framework (REF) 2021

90% of the Business School’s submitted research to be either ‘world-leading’ or ‘internationally excellent’ overall

More on Research Excellence Framework (REF) 2021

About us

Leeds University Business School is a faculty of the University of Leeds, one of the leading higher education institutions in the UK. In a world of complexity and constant change, whether technological, environmental or economic, we encourage students and businesses to recognise the opportunities to make a positive difference. We believe in the power of business education, research and innovation to change the world for the better.

We are ranked in the top 100 universities in the world (QS rankings 2025) and are a member of the prestigious Russell Group of research-intensive UK universities. We deliver undergraduate, Masters, MBA, PhD, executive and professional education and online study, for over 5,000 students from around 100 countries. We are one of a small number of business schools worldwide to be triple-accredited by AACSB, AMBA and EQUIS.

Accreditations

We are triple accredited and hold numerous major accreditations from leading international bodies, in recognition of our research and teaching excellence.

More on AccreditationsMission and values

Our mission is to make an exceptional impact on business and society globally through leadership in research and teaching.

More on Mission and valuesFaculty Executive Group and International Advisory Board

The Faculty Executive Group drives the strategic direction of the Business School.

More on Faculty Executive Group and International Advisory BoardSustainability

Discover how we are tackling global challenges to become greener and more sustainable

More on SustainabilityEquality and inclusion

Leeds University Business School is committed to creating a fully inclusive environment for staff, students, alumni and partners.

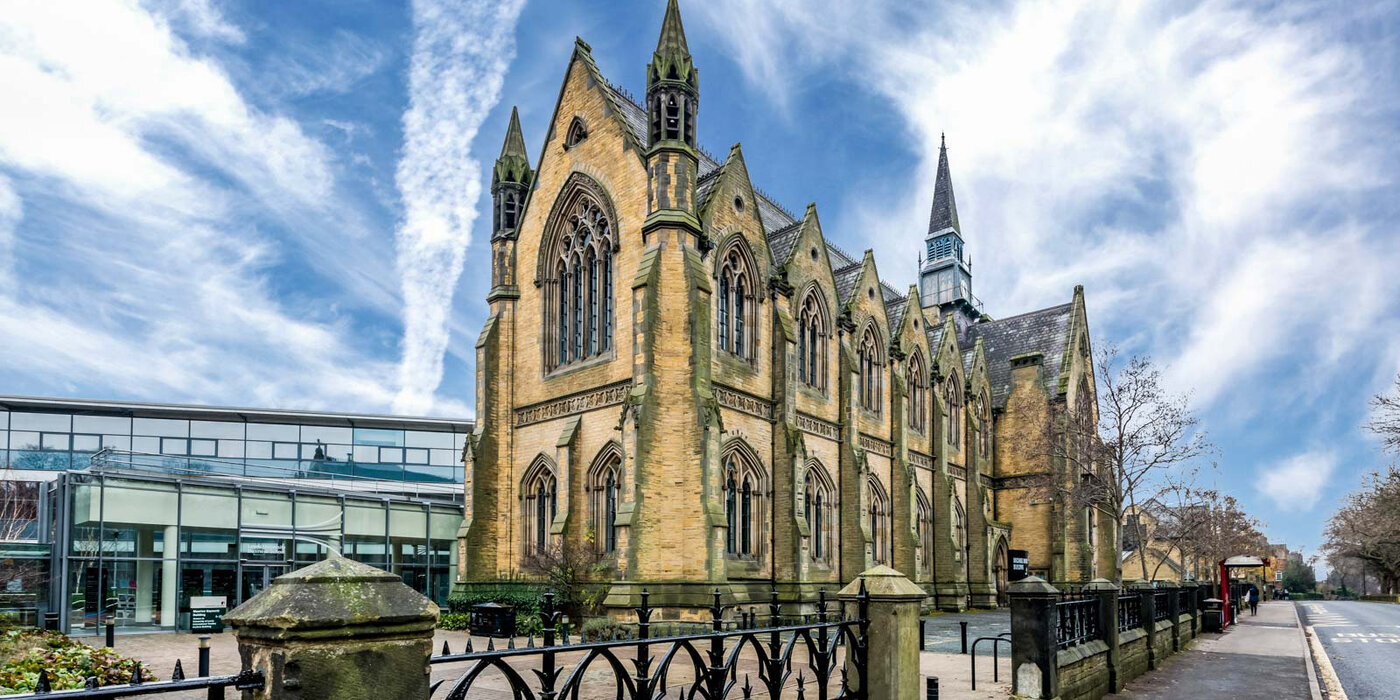

More on Equality and inclusionWorld class facilities

Housed in impressive facilities on the University of Leeds’ Western Campus.

More on World class facilitiesInternational reach

We work with over 200 institutions worldwide, through research projects, teaching, programme development, conferences, networks, International Advisory Board and student programmes.

More on International reachDepartments

Our seven departments form the framework for our teaching and research, including domestic and international collaborations via our interdisciplinary research centres.

More on DepartmentsCERIC Migration Workshop

Thursday 17 July 2025 - Friday 18 July 2025

More on CERIC Migration WorkshopLagos alumni social: Build connections and network

Friday 18 July 2025, 18:00 - 19:30

More on Lagos alumni social: Build connections and network